"Windmills are driving whales crazy", "they are not truly green", the current occupant of the White House has said at the beginning of the year as he was about to take office. Nearly a year later, amid record rises in retail electricity prices, it's the Trump administration's systematic attempts to undermine offshore wind development on the US East Coast that is driving people crazy. Especially the working-class Americans who are the most vulnerable to the affordability crisis that drove them to vote for the Republicans in the last election. Unfortunately for these workers struggling to make ends meet, the Trump administration is scoring an own goal by actively stymieing the development of US coast offshore wind, development which has the potential to mitigate the rapid rise of retail electricity prices in the North East.

In this blog post we will move beyond the often-misleading slogans and focus on the economic reality on the ground: that large scale offshore wind (OW) development off the US East Coast (EC) has the potential to mitigate the rapid rise of retail electricity prices that is compounding the affordability crisis for ordinary Americans. And that the current administration's baseless campaign to stop this development will only exacerbate it.

With the preamble out of the way, let's dive into the facts on OW development off the East Coast, focusing on 4 key points:

-

How does the current Levelized Cost of Electricity (LCOE) of offshore wind compare to retail electricity prices and how will the balance shift in the future with additional load growth such as data centres?

-

Given the realities of high population density, political opposition (NIMBYism), grid congestions and the cost of transmission, how expensive is offshore wind compared to far-away large-scale renewables like Midwest onshore wind and Southwest solar?

-

How the Trump administration's actions against offshore wind will inevitably worsen the affordability crisis in the Northeast US by artificially driving electricity prices higher.

-

Why Trump's war on offshore wind is contrary to free-market principles and actively hurting the working-class voters he claims to champion

Offshore Wind LCOE vs. North East US Retail Electricity Prices

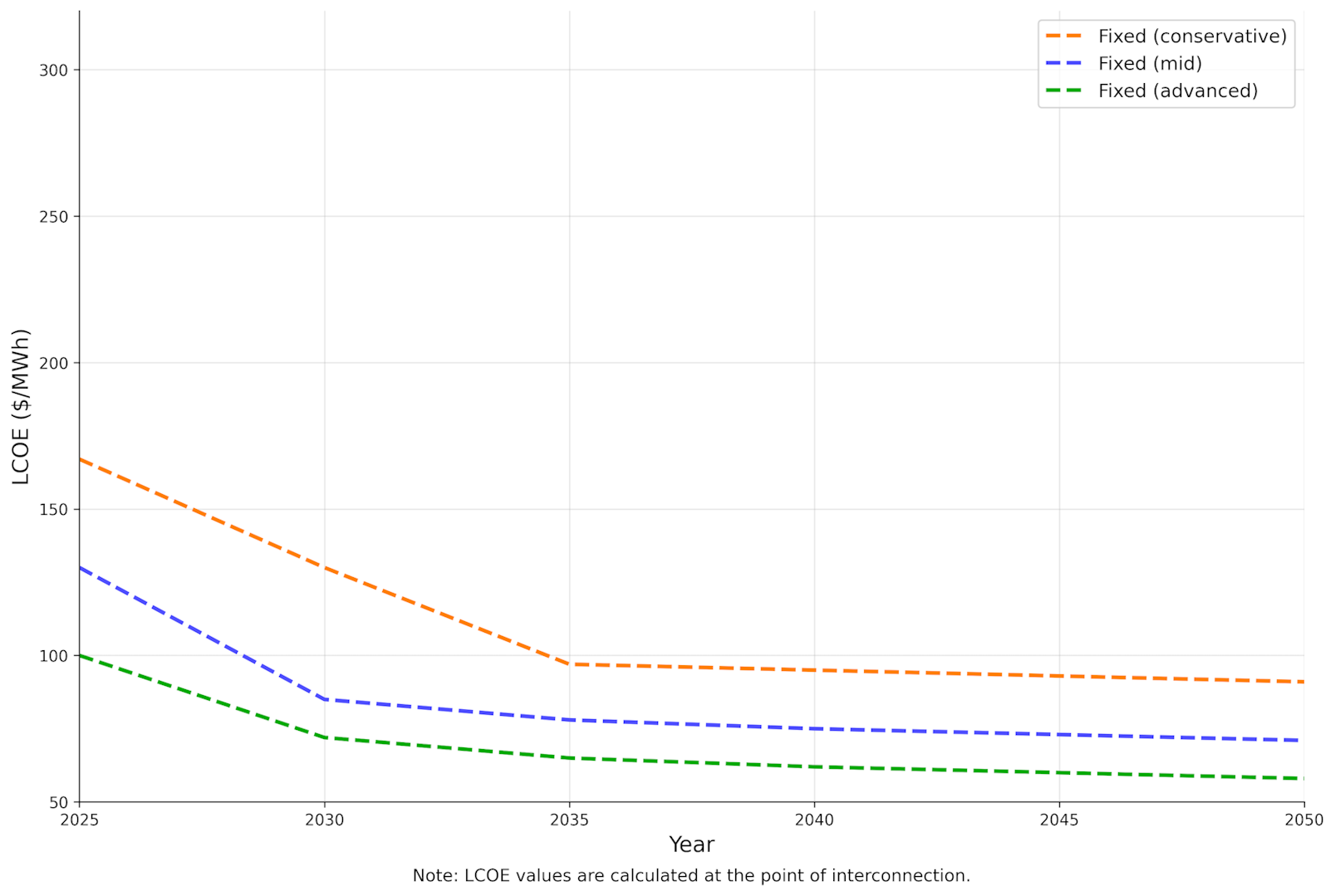

The LCOE for offshore wind in the Northeast U.S. is competitive with, and often lower than, prevailing retail electricity prices, with potential for further cost declines. As reported by NREL, the US National Renewable Energy Laboratory, the current LCOE for offshore wind in the Northeast is estimated to be around $129/MWh for projects coming online in 2025, with some competitive projects such as Dominion's 2GW Coastal Virginia Offshore Wind achieving lower figures of about $91/MWh by 2026. By 2050 NREL projects these costs to fall to $90/MWh, $72/MWh, and $57/MWh in 2050 for the conservative, mid, and advanced scenarios, respectively. These figures reflect ongoing supply chain challenges and inflationary pressures but are bolstered by economies of scale and technological advancements, such as larger turbines and improved installation methods.

Meanwhile, retail electricity prices in the Northeast U.S., propelled by high fuel costs, grid congestion, and growing demand, frequently exceed these LCOE figures, especially during peak periods where prices surpass $200/MWh. As of mid-2025, average residential rates in the region hover around 20-25 cents/kWh (or $200-250/MWh), with peak-period wholesale prices frequently exceeding $200/MWh during high-demand events like winter storms or summer heatwaves. For instance, in ISO-New England (serving Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont), wholesale prices spiked to over $136/MWh in August 2025 due to congestion and outages, while residential rates in Massachusetts rose 33% from 2022 levels amid global gas price volatility. Nationally, the U.S. Energy Information Administration (EIA) forecasts average residential prices at 16.8 cents/kWh ($168/MWh) for 2025, up 2% from 2024, but Northeast states consistently exceed this by 20-50% due to their heavy reliance on imported natural gas.

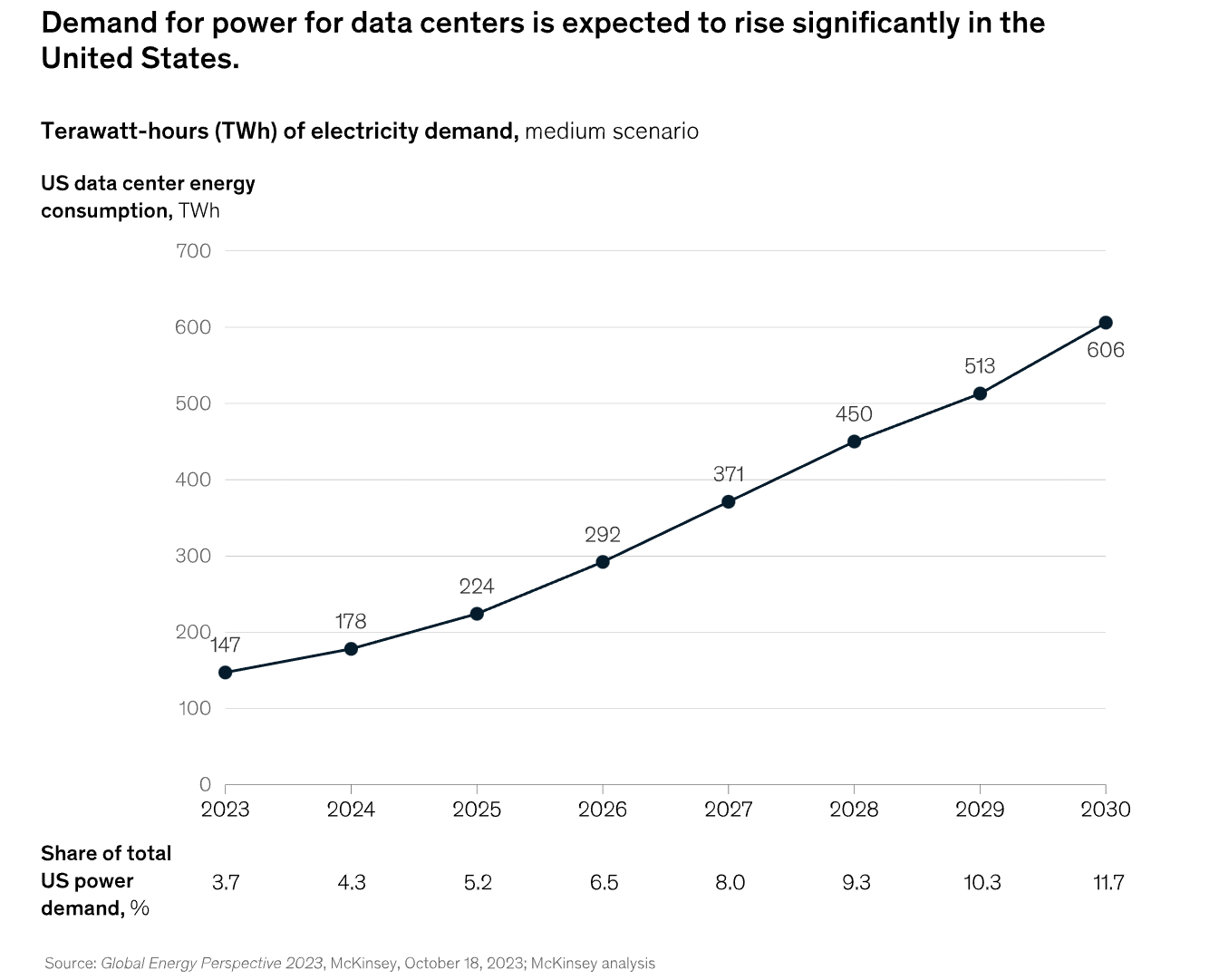

This cost advantage for offshore wind is poised to widen in the coming years as electricity demand surges from new large-scale loads, including data centres and electrification of transportation and heating. Data centre electricity consumption has tripled over the past decade and is projected to double or triple again by 2028, driven by AI and cloud computing expansions, potentially accounting for 30-40% of net new U.S. demand through 2030. In the Northeast, where data centres are geographically concentrated due to low-latency needs (e.g., in Virginia and New York), this could add 10-25% to regional electricity bills by 2030 if unmet by low-cost renewables according to the latest reports by McKinsey and S&P Global. Electrification initiatives, such as electric vehicle adoption and heat pump deployment, will further strain the grid, with New England alone facing 20 GW of peak demand growth by winter 2025-2026—much of it from data centres and industrial reshoring.

How does EC Offshore Wind compare to other large-scale renewable generation?

Let's play the devil's advocate for a moment: Given the fact that the LCOE of onshore wind and solar is cheaper than that of offshore wind, wouldn't it make sense to bet on these sources to feed the growing demand in the North East US and mitigate the cost rises for the retail consumer?

While in situ deployment of solar and wind is without a doubt the cheapest option in places where land is not an issue, this is obviously not the case in the most densely populated region in the United States. While there are certainly small-scale developments of commercial solar parks and wind farms in the northeast US, not to mention rooftop solar, they are not enough to power the northeast grid, even discounting future demand growth. Consequently, we have to look further away, specifically to the US Midwest for large scale wind projects and the SW US for large scale solar. The question then becomes the additional cost of transmission and grid congestion. In other words, what is the real cost of onshore wind and solar from far away sources, given the economic and political realities of long-distance transmission.

Northeast grid congestion alone imposes steep penalties: In 2022, U.S.-wide congestion costs hit $20.8 billion (up 56% from 2021), with ISO-New England and NYISO seeing 72% year-over-year spikes in 2021 due to transmission outages, winter storms, and increasing demand. These costs—passed directly to consumers via higher locational marginal prices (LMPs)—totalled $12 billion across six major RTOs in 2022, equivalent to $13-21/MWh added to delivered energy. NIMBYism and density further tilt the scales. High population along the Atlantic seaboard blocks onshore renewables: New York and Massachusetts have rejected numerous Midwest wind import proposals due to eminent domain fights and visual/noise concerns, delaying projects by years and inflating costs via legal battles.

Let's dig into the numbers: The LCOE for large-scale onshore wind in the Midwest US is currently around $30–$50/MWh, and $30–$45/MWh for large-scale utility solar, in regions like the Midwest and Southwest, where solar resources are particularly strong. However, the addition of transmission costs renders the final price of delivered electricity for Northeast consumers in the range of $60–$90/MWh today. Projections for 2030 and beyond suggest that while generation costs for both Midwest wind and large-scale solar may drop slightly due to technological improvements ($25–$35/MWh), transmission costs are likely to remain steady or even rise due to congestion and the need for new high-voltage lines, keeping delivered prices in the range of $55–$85/MWh for the Northeast unless there is major transmission investment and regulatory alignment.

This is comparable to the cost range of $57/MWh to $90/MWh for EC Offshore Wind, but these projections might be optimistic: we have mentioned there is significant political opposition to expanding transmission capacity, not to mention additional load growth in other parts of the US which implies additional transmission costs en route to the Northeast. Moreover, from a security and grid resilience standpoint it is logical to diversify the region's electricity supply and not be wholly dependent on a few transmission bottlenecks.

How the Trump Administration's war on offshore wind will drive up prices for NE Consumers and exacerbate the affordability crisis in the region

Between 2021 and 2023 Offshore Wind developers have faced higher financing, procurement, and construction costs -- rising 27–65% for some Northeast projects between 2021 and 2023 due to inflation, supply chain impacts, and regulatory headwinds. Instead of working with the developers to find ways to mitigate these costs, the Trump administration has effectively declared war on offshore wind.

The Administrative Assault

Leasing moratoriums, permit revocations, funding cancellations, and regulatory overhauls threaten to exacerbate the Northeast's electricity affordability crisis by blocking a critical low-cost, local supply source and forcing greater dependence on volatile fossil fuels and inflating prices amid surging demand.

Since January 2025, the administration's actions have included: - A blanket withdrawal of all Outer Continental Shelf (OCS) areas from wind leasing (effective January 21, 2025, until revoked) - Halting construction on 80%-complete projects like Revolution Wind ($4 billion, off Rhode Island) - Revoking approvals for SouthCoast Wind (Massachusetts), New England Wind (Martha's Vineyard), and Maryland Offshore Wind (114 turbines) - Cancelling $679 million in port infrastructure grants for 12 wind-supporting projects (including a planned offshore wind hub in Brooklyn) - Ordering agency-wide reviews probing "national security" and wildlife impacts, effectively stalling over half of planned U.S. offshore capacity

Permits were "final" under Biden-era reviews, yet Trump's orders bypass due process, echoing unsubstantiated claims of "unreliability".

The Economic Impact on Consumers

By actively suppressing Offshore Wind, the Trump administration is directly hitting the pocket book of Northeast consumers. Offshore Wind is a reliable electricity source: with average capacity factors for new projects at 40–60%, it is comparable to conventional power plants. The US Energy Information Administration (EIA) and Daymark Energy project that, without the stabilising effect of offshore wind, reliance on expensive gas "peaker" plants could drive rate hikes of up to 13% in the next two years, disproportionately affecting low-income households -- especially in the Northeast, where energy bills can already consume 10–15% of household income.

The Jobs and Investment Casualties

Furthermore, by derailing projects like Revolution Wind (slated for 2026 operation), the administration risks 17,000+ jobs and $9.4 billion in investments that would have disproportionally benefited low-income communities with high-paying blue-collar jobs.

Many offshore wind projects focus on revitalising ports and industrial sites proximate to low-income urban and coastal communities, delivering not only jobs but also investments in infrastructure and environmental improvements. Offshore wind projects also generate skilled, high-paying blue-collar jobs spanning multiple sectors such as construction, manufacturing, Operations & Maintenance, and Marine and Transportation. These jobs offer family-sustaining wages with benefits, often accessible without a four-year college degree, thus benefiting working-class households and communities with limited access to other high-wage opportunities.

Development of East Coast Offshore Wind is pro free-market: Trump's energy policies are dirigisme

The Central Planning Hypocrisy

The current president's self-proclaimed devotion to free-market capitalism, echoing Reagan-era deregulation, crumbles under scrutiny, as his 2025 energy agenda deploys sweeping federal mandates to dictate winners and losers, evoking the central planning of communist regimes or fascist corporatism where state power enforces ideological preferences over economic merit.

While decrying Biden's Inflation Reduction Act as "market-distorting," Trump wields executive orders like blunt instruments: a January 20, 2025, memo indefinitely withdrawing all OCS from wind leasing, a July 7 order axing clean energy tax credits for "unreliable" sources, and April 8 directives blocking state climate laws as "illegitimate impediments." These aren't market signals; they're top-down decrees, halting nine permitted East Coast projects (five under construction) based on unsubstantiated gripes: whales going crazy (debunked by scientists), "ugliness," or vague "national security" probes, while fast-tracking fossil approvals without bids. Project 2025, penned by prominent Trump alumni, explicitly calls for DOE to cease "subsidising renewables" and repeal IRA provisions, yet ignores fossil subsidies ($20B/year) that truly warp prices, mirroring Soviet Gosplan's favouritism for heavy industry over consumer needs.

Who Really Benefits

This isn't laissez-faire; it's fascist-style dirigisme, where government fuses with select industries (oil/gas) to crush rivals, as seen in Trump's LNG export lift sans environmental review, while imposing steel tariffs that hike wind costs 20%+. Republicans that once lambasted such interventions: e.g., coal props as "big government", now cheer Trump's "industrial policy" for fossils, converging with Democrats in picking winners, per American Action Forum analysis. His personal vendettas, railing against turbines from his Scottish golf courses, override economics, at the expense of working-class Americans.

The Market Has Already Spoken

Even global finance rebuffs this: Markets added 96% renewables to U.S. grids in 2024 despite rhetoric, as clean energy's cheaper power (states with high renewables save 23.4% vs. fossil-heavy ones) trumps political theatre. The active suppression of East Coast offshore wind in the face the steep rise of regional electricity costs is a stark example of this. Free markets thrive on competition, not capricious vetoes: Trump's authoritarian energy policy serves the elite, not the "forgotten" consumer he claims to champion.

As a dominant China is taking the lead in the global clean energy race by actively supporting its industry to further decrease costs, the Trump administration is increasing the costs of doing business in the US by ponying up to special interests. Adam Smith's invisible hand doesn't hold a MAGA hat. Markets, not Mar-a-Lago, should decide America's energy future!