Picture this. It's October 2025. As the wind turbines sit still and solar panels languish under a grey autumn sky, Germany is in dire need of electricity. The bureaucrats in Berlin and Brussels are trading blows over building new gas capacity. Meanwhile, coal, supposedly a relic of the dirty past, has temporarily won this fight. This is not the green clean future German citizens were promised by their government.

What went wrong? The answer is two German words: Energiewende and

The Dream That Became a Nightmare

Back in 2010, the German government announced the Energiewende with characteristic confidence: Germans would show the world how an advanced industrial economy could transition to renewable energy through careful planning, generous subsidies, and sheer political will. The targets were ambitious but theoretically achievable: 80% renewable electricity by 2050, industrial leadership in green technology, energy independence from Russia, and, of course, moral superiority over those reckless French with their dangerous nuclear plants.

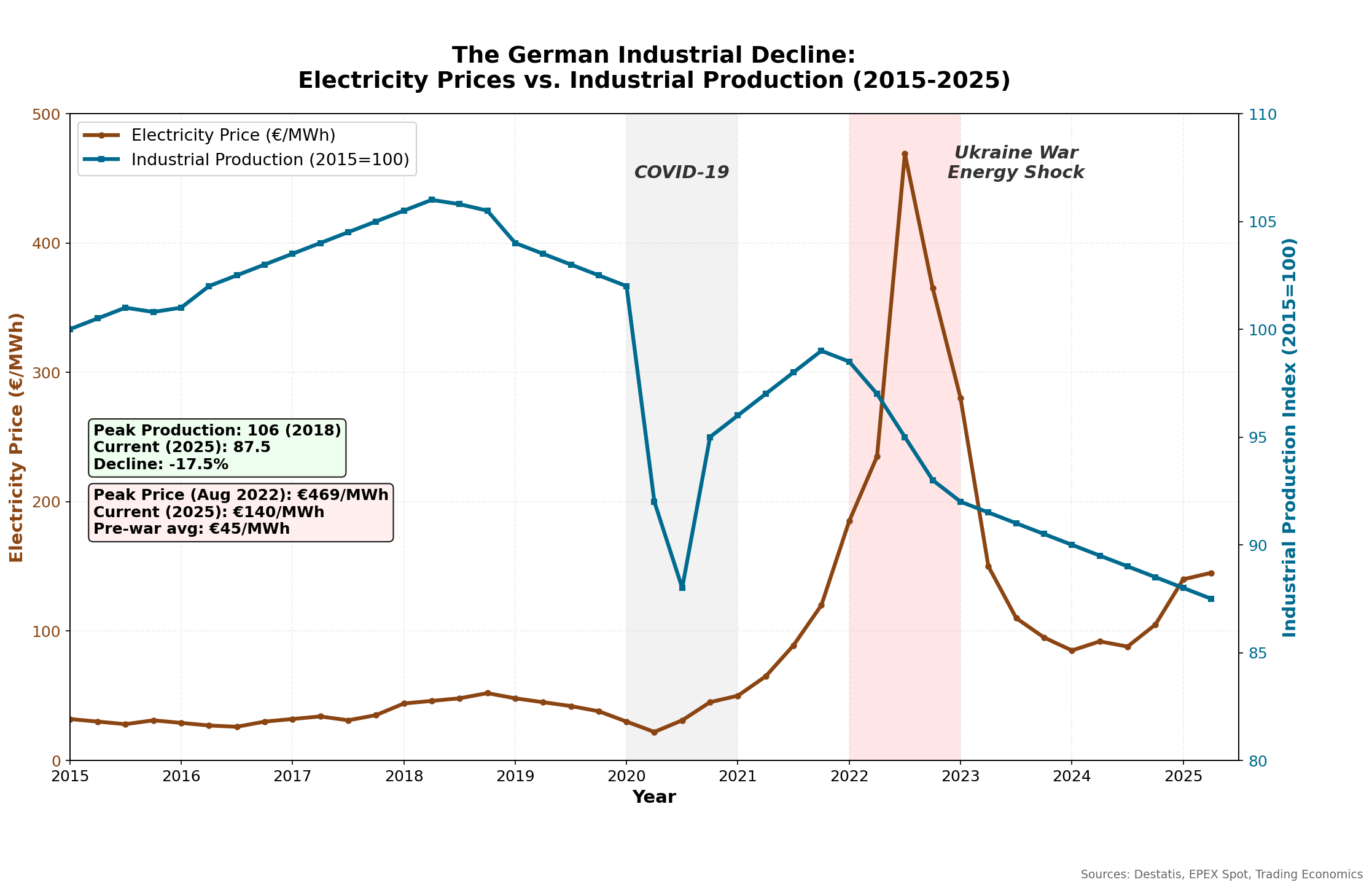

Fifteen years and €520 billion later, the reality reads like a satirical novel about central planning. The statistic that most starkly tells the story of this failure is electricity prices. In early 2025, German wholesale electricity consistently trades at a €50-80/MWh premium above France, with 2026 futures showing French prices projected to remain 40% lower. During winter months, when renewable generation drops and heating demand soars, this premium can exceed €100/MWh. Coal still provides 25% of Germany's electricity generation in 2025, among the highest in Western Europe, surpassed only by Poland. The chemical industry, backbone of German manufacturing, is fleeing to America and China where electricity doesn't cost more than raw materials. As for the vaunted green hydrogen economy that was supposed to replace fossil gas? Production sits at less than half the targeted levels, with most pilot projects quietly abandoned after discovering that the laws of thermodynamics apply even in Germany.

A Nuclear Own Goal

April 2023 marked the culmination of what can only be described as the biggest own goal committed by an advanced industrial democracy. The shutdown of the country's last three nuclear reactors removed 4 gigawatts of reliable, carbon-free baseload power from the grid. These weren't aging Chernobyl-style relics; they were modern, profitable plants with decades of operational life remaining, producing electricity at around €30/MWh.

How could a nation known for its industrial prudence and enlightenment thinking make such a spectacular blunder?

In 2011, panicked by Fukushima in Japan, Merkel's government ordered eight nuclear plants shut immediately, with the remaining eight to follow by 2022. The plan assumed Russian gas would bridge the gap until renewables scaled up. Instead, Putin's 2022 invasion exposed the idiocy of swapping zero-carbon nuclear for fossil fuel dependency.

After Russia's invasion of Ukraine in February 2022, it sharply reduced and eventually halted gas supplies to Germany by mid-2022, disrupting this energy supply chain and triggering a crisis. This forced Germany to rapidly increase coal-fired power generation to ensure baseload electricity, despite earlier plans to phase out coal by 2030/2038. The war thus exposed Germany's energy vulnerabilities created by closing zero-carbon nuclear plants and overreliance on Russian gas, leading to a temporary reversal toward coal and expensive energy imports to stabilize the grid during supply shortages.

The immediate result surprised nobody except apparently German policymakers: coal plants, which had been scheduled for retirement, suddenly found themselves indispensable. Brown coal, the dirtiest form of electricity generation known to humanity, roared back to life. The arithmetic is brutal: shutting down those nuclear plants added approximately 15 million tonnes of CO2 annually to Germany's emissions, equivalent to adding 3 million cars to the roads.

The irony reaches peak absurdity when examining import data. In December 2024, Germany imported 1,624,331 MWh from France, followed by 1,791,010 MWh in November, making France by far Germany's leading electricity supplier. These aren't emergency imports during rare events; monthly imports from France now consistently run at 1.6-1.8 TWh, essentially replacing a good portion of the nuclear capacity Germany voluntarily destroyed. Germans are literally paying a premium for the same split atoms they declared too dangerous for German soil.

To use a football analogy: Germany's nuclear phase-out was more catastrophic than Brazil's 7-1 semi-final defeat in 2014. The difference? The Mannschaft won that tournament. This time, Germany is Brazil, humiliated on home turf by their own overconfidence, except there's no redemption arc coming.

The Industrial Exodus Nobody Talks About

As if the fallout from the "nuclear blunder" was not enough, the high prices triggered by the abrupt shutdown of imports of cheap fossil gas from Russia triggered an industrial meltdown in a country reliant on heavy, energy-intensive industry for much of its GDP.

While German politicians debate the finer points of renewable energy certificates, German industry is voting with its feet, and those feet are walking toward the exits. BASF, the chemical giant that has called Ludwigshafen home for 160 years, announced it's shifting production to Louisiana and China, where fossil gas costs a quarter of German prices and electricity half as much. Volkswagen, the pride of German engineering, is building its new battery plants in Canada, not Brandenburg. Arc furnace steel production has dropped 20% as producers relocate to countries with cheaper electricity.

The Mittelstand, those small and medium manufacturers that form the backbone of German industrial might, are quietly closing up shop after surviving two world wars but not the Energiewende. A typical zinc plating company in Bavaria recently shut down after 120 years in business, leaving a note that should be carved on the Energiewende's tombstone: "We can't compete when our electricity costs more than our workers."

The numbers tell a story of industrial decline that would make Thatcher's Britain look like a manufacturing renaissance. Energy costs are now three times US levels. When you don't know what energy source will be legal in five years, why invest in fifty-year infrastructure?

The Dunkelflaute Humiliation

Dunkelflaute. Leave it to the Germans to have a word for "that awkward moment when your entire renewable energy system stops working." These periods of simultaneous wind calm and cloudy skies aren't rare anomalies; they're regular features of German weather, occurring multiple times each winter when electricity demand peaks.

The most recent major episode in October 2025 perfectly illustrated the systematic failure. For several days, Germany produced less electricity than it consumed, with wind and solar generation dropping to near zero. The country that once lectured others about energy independence found itself desperately importing power from France, Austria, and the Czech Republic. During this period, German spot prices routinely exceeded neighbouring countries by €70-80/MWh, a premium German consumers and businesses paid for the privilege of having dismantled their reliable baseload capacity.

Battery storage, touted as the solution, can currently provide about half an hour of national consumption, leaving German consumers in the lurch. The physics lesson is elementary: you can't regulate weather, you can't subsidise wind into existence, and you can't store winter electricity in summer batteries that don't exist. France, meanwhile, continued generating 70% of its electricity from nuclear plants at a steady 50 grams of CO2 per kilowatt-hour, while Germany's grid carbon intensity spiked to 350 grams, seven times higher than the country they love to lecture about nuclear safety.

Government Missteps Compound the Problem

The bureaucratic obstacles to renewable deployment would be darkly comic if the consequences weren't so severe. Germany now holds the dubious distinction of the longest wind permitting times in the developed world, 5 to 7 years from application to operation. Bavaria's "10H rule," introduced in 2014 under CSU leadership, mandates that wind turbines must be at least ten times their height away from residential buildings. For a typical 200-meter turbine, this creates a 2-kilometer exclusion zone that renders 99% of Bavaria's land area unbuildable for wind. The same municipalities that once championed the Energiewende discovered that "renewable energy" meant turbines should grace someone else's horizon.

The Scholz administration, which took office in December 2021 just as the energy crisis erupted, initially doubled down on the contradictions. In the desperate scramble following Russia's February 2022 invasion of Ukraine, the government simultaneously accelerated coal plant operations while maintaining solar import tariffs that made Chinese panels 30% more expensive. When Germans needed cheap renewable capacity fastest, their government was making renewable equipment costlier, apparently solving high electricity prices by increasing costs.

The February 2025 collapse of Scholz's traffic light coalition and the subsequent election victory of Friedrich Merz's CDU/CSU promised a reset. Yet under pressure from an energy-squeezed electorate, Merz has found himself trapped between competing forces. The new government has quietly rolled back some Energiewende provisions such as extending the lifetimes of remaining coal plants and easing some renewable permitting requirements, while simultaneously maintaining the core fiction that Germany can achieve climate targets without nuclear power.

Enter the extreme-right Alternative für Deutschland (AfD), now polling ahead of the CDU in several eastern states. Alice Weidel, its charismatic populist leader, has explicitly promised a moratorium on all new wind turbine construction if the party enters government, framing turbines as "industrial scars on the German landscape" that deliver neither energy security nor affordable power. The AfD's rise correlates precisely with electricity price spikes: in regions where power costs have doubled since 2021, AfD support has surged 10-15 percentage points. Germans aren't voting for the far-right because they love coal; they're voting against an establishment that spent €520 billion of their money and delivered higher prices, lower reliability, and lectures about doing more.

The comedy of errors extends to Brussels, where EU bureaucrats blocked Berlin's plan to construct 20 GW of new gas-fired backup capacity, citing state-aid concerns. The approved volume was slashed to 12-12.5 GW, leaving a capacity gap that officials insist will be filled through "storage, flexible consumption, and demand management," bureaucrat-speak for "we have no idea."

Light at the End of the Dunkelflaute?

Germany's energy future isn't entirely bleak, but salvation will come from markets, not mandates. The silver lining to catastrophically high electricity prices is that they're finally triggering the correct market responses that should have occurred a decade ago if government hadn't distorted every signal.

Offshore Wind's Untapped Potential

Germany possesses some of Europe's most abundant offshore wind resources in the North and Baltic Seas. Current installed capacity sits at just 8.5 GW, a fraction of the technically feasible 70+ GW potential. Unlike Bavaria's landlocked NIMBYism, offshore projects face fewer permitting obstacles and deliver higher capacity factors (45-50% vs. 20-25% for onshore). The missing piece isn't turbines, it's transmission. Connecting northern wind to southern industry requires building the high-voltage lines that local governments have blocked for years. Merz's government has finally begun to streamline approvals, but the projects won't deliver electrons until the late 2020s.

The Nordic Connection

Norway and Sweden's abundant hydropower offers the perfect complement to German wind and solar: dispatchable, renewable electricity that can fill gaps during Dunkelflaute. Norway alone could provide 30 TWh annually through existing interconnectors, with plans to triple capacity by 2030. Here's where markets excel: Nordic power trades at €30-50/MWh while German prices regularly hit €100+/MWh. That price differential is doing more to drive interconnector investment than any government programme. Private capital is flooding into transmission projects because the arbitrage opportunity is enormous. If Berlin and Brussels simply approved these projects faster instead of commissioning studies about environmental impact statements, the electrons could flow tomorrow.

Battery Storage's Market-Driven Explosion

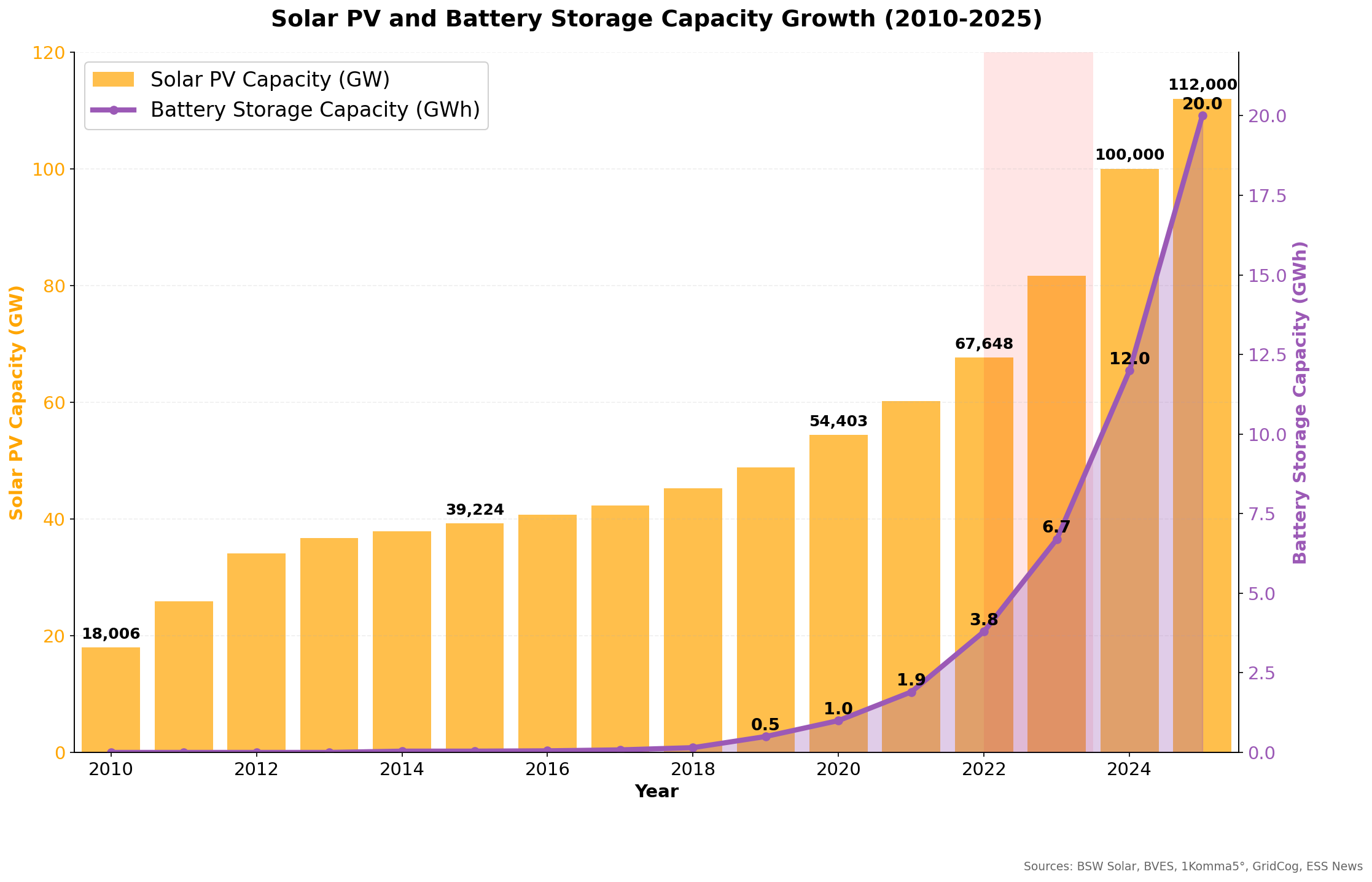

Germany's battery storage capacity has quintupled since 2021, reaching 15 GW by early 2025, and this growth is accelerating. Unlike the Energiewende's top-down approach, this deployment is purely market-driven. Storage operators make money by buying cheap renewable electricity during midday solar peaks and selling during evening demand spikes. No subsidies required, the price volatility that politicians created by shutting down baseload is now financing the solution.

The cautionary note: government must resist the temptation to "help." Recent proposals to mandate battery locations or cap profit margins would slow deployment precisely when the market is solving the problem. Let prices do what prices do, signal scarcity and reward solutions!

Rooftop Solar's Revolution

Perhaps the most encouraging development receives the least attention. Since Russia's invasion triggered the energy crisis, German households and businesses have installed over 12 GW of rooftop solar, more capacity in three years than the previous decade. When retail electricity hits €0.40/kWh while solar installation costs have dropped to €1,200/kWp, the payback period is under six years. Germans are voting with their wallets, self-insuring against grid volatility and utility price gouging.

Small businesses are leading the charge. The Mittelstand manufacturer who can't relocate to Texas can at least generate daytime power on-site. Combined with battery storage, these systems provide partial energy independence, not from environmental virtue but from economic necessity. The market works when you let it!

The Common Thread

The pattern is clear: markets work when government gets out of the way. The lesson isn't that Germany needs better plans. It needs to stop planning. Remove the transmission vetoes. Approve the interconnectors. Eliminate the import tariffs. Let storage operators profit from volatility. Allow households to generate their own power without bureaucratic permission.

The Energiewende failed because it tried to engineer outcomes. The energy transition might yet succeed by getting government out of the way so markets can discover solutions that no committee in Berlin could have predicted.

Conclusion: Physics, Markets, and the Path Forward

The Energiewende isn't dying from lack of commitment or funding, it's dying because you can't suspend physics by government decree. Fifteen years and €520 billion later, Germany has proven that central planning can't outsmart thermodynamics, that political will can't replace reliable baseload, and that virtue signalling generates no kilowatt-hours.

Yet paradoxically, Germany's expensive failure is now financing the correct solutions. Sky-high electricity prices, the direct result of misguided policy, have triggered exactly the market responses that rational energy planning would have pursued from the start. Offshore wind, Nordic interconnectors, battery storage, distributed solar: these aren't government programmes achieving targets, they're market actors responding to price signals. The invisible hand doesn't speak German, but it understands profit margins perfectly.

As October's Dunkelflaute reminded everyone, Europe's industrial powerhouse still depends on its neighbours when the wind stops and the solar panels sleep. That's not an energy transition, it's an energy tragedy. But perhaps the final act hasn't been written. If German politicians can learn the hardest lesson of all, that their most valuable contribution is getting out of the way, there may yet be light at the end of this expensive dunkel tunnel.

The question isn't whether markets can solve Germany's energy crisis. They already are. The question is whether politicians will let them.