This week, at the 30th United Nations climate change conference (COP30) in the Amazonian city of Belém, while the United States sulked at home, delegates from Thailand to Tanzania queued up to enter the Chinese pavilion, by far the largest in the conference hall. They weren't lining up for souvenir Chinese flags or pictures of President Xi. They were clamouring for something far more valuable: cheap Chinese solar panels that can give their citizens cheap and abundant electricity. The irony was lost on no one: the world's largest polluter has become the planet's decarbonisation dealer, and they did it by being better capitalists than the United States.

China exported approximately $67 billion in solar panels in the first eight months of 2024, with total exports for the full year likely exceeding $80 billion, far above previous years and dwarfing the US's solar panel exports, which stood at just $69 million annually in recent years. Let that sink in: a 1,000-fold difference! So how did we get to this point? How did the world's most powerful country and the global champion of free-market ideology lose an entire industry to what is still, nominally, a communist regime? The short answer is that despite the Marxist façade, China has incorporated the lessons of cut-throat capitalism at its finest to produce this remarkable result. For the fascinating details, let's dig in!

The Original Sin: America Invented Solar and then Fumbled It Away

We may think of solar power as a newfangled invention. The reality is far from it: our discovery that sunlight can produce electrons dates almost as far back as the first scientific explorations of electricity, way back in the 19th century. It was, however, in post-war America that three brilliant researchers, Daryl Chapin, Calvin Fuller, and Gerald Pearson, created the first practical silicon photovoltaic cell whilst working at Bell Labs in New Jersey. Chapin was trying to solve a mundane problem: keeping telephone repeaters powered in humid tropics where batteries failed. On 25 April 1954, they demonstrated a silicon cell with 6% efficiency, a leap from the 1% selenium predecessors. The New York Times splashed it across the front page as a 'solar battery' made from sand. Costs were astronomical ($1,000/watt), but it powered small devices and, crucially, launched the space race: Vanguard I in 1958 became the first satellite powered by solar.

The next 20 years? A roller-coaster of hope and neglect. Facing repeated energy price shocks due to the Middle East oil embargo compounded by the Iran hostage crisis, Jimmy Carter installed 32 panels on the White House in 1979, declaring solar the path to energy independence amid oil shocks. But when oil prices crashed in the 1980s, Reagan ripped Carter's panels off the roof (they ended up in museums). Federal R&D funding got slashed. All the whilst, efficiency crept up: Hoffman Electronics hit 14% by 1960. By the 1980s laboratory silicon cells surpassed 20% whilst commercial panels averaged 13-15%. The inexorable rise of solar power proceeded at pace, but with the lack of supportive policies, the US was no longer in the lead.

In the 1990s and early 2000s, Germany's Renewable Energy Act (EEG) and generous feed-in tariffs triggered a domestic solar boom, making Germany the biggest market and attracting manufacturing, R&D, and international investment. German firms and government policies provided stability and high-tech demand, allowing the country to outpace US manufacturers. But it was not to last: China was waiting in the wings.

Enter the Dragon

Around 2003, Premier Wen Jiabao looked at China's skyrocketing growth and saw a nightmare: massive dependence on imported Middle East oil, vulnerable to blockades or price spikes. In the early 2000s China was literally choking in smog: energy independence wasn't environmental policy or green virtue signalling, it was a matter of national security. Wen quietly shifted policy: renewables became industrial strategy. The 2005 Renewable Energy Law set targets, feed-in tariffs, and mandatory grid connections. What started as a quest for securing domestic power turned into a manufacturing flywheel.

Creative Destruction Done Right, and Gone Horribly Wrong

From 2008-2012, China unleashed a polysilicon gold rush. Polysilicon is the primary material used to manufacture the solar cells inside most modern solar panels; it forms the core semiconductor that converts sunlight to electricity in crystalline silicon photovoltaic (PV) modules. Over 300 companies flooded in, backed by cheap state loans and local governments hungry for jobs. The Communist Party didn't micromanage winners; it let the market rip. Polysilicon prices plummeted from $400/kg to under $10/kg in a savage price war. Ninety per cent of firms went bust, factories shuttered, fortunes lost. Out of the carnage emerged 10 vertically integrated titans, Tongwei, GCL, LONGi, Jinko, with scale and costs no one could match. To put it into perspective:

- In 2000, China was a minor player, with global supply dominated by European and American companies.

- By 2010, China's share grew significantly due to government investment, reaching about 60% of global production.

Meanwhile over in the US, after the fossil fuel-soaked Bush years, the new Obama administration realised that America needed to dominate the clean energy future. Unfortunately, the high hopes hit a major stumble by the name of Solyndra.

In 2009, Obama's stimulus poured billions into 'green jobs'. Solyndra, with its innovative cylindrical thin-film tubes (supposedly better at capturing diffuse light), got the first loan guarantee: $535 million taxpayer dollars. Obama visited the factory, hailing it as the future. Vice President Biden beamed in via satellite. Reality hit hard. Chinese crystalline silicon panels flooded the market at half the price. Solyndra's tech couldn't compete. By 2011, it was bankrupt: $528 million lost, 1,100 jobs gone overnight. FBI raids followed amid allegations executives misled the DOE about finances. Private investors (including Obama donors) got priority in restructuring, leaving taxpayers holding the bag.

Solyndra became the poster child for crony capitalism: government picking winners, ignoring warnings, propping up losers. Whilst China let 90% of its firms die to birth giants, America threw half a billion at one flashy failure.

The Manufacturing Masterclass and the Accidental Empire

The following decade not only sealed China's domination of solar panel manufacturing: it unleashed hitherto unimaginably low prices and gargantuan production scales which no country on earth could match.

The numbers are staggering:

- Solar module costs plummeted from $4.60/W in 2010 to around $0.10/W by 2025.

- China's global market share exploded from 15% in 2005 to over 80% in 2025.

- Global installation costs slashed by 90%, thanks almost entirely to Chinese scale.

- In 2024, China installed a record 277.17 GW of new solar capacity, bringing its total cumulative installed solar power to approximately 887 GW by the end of the year.

- For comparison, in 2024, the total installed electrical power capacity from all sources in the United States was approximately 1,300 GW.

How did the Chinese do it?

Vertical integration on steroids: Chinese firms control everything from polysilicon mines to finished modules. The Chinese used their massive domestic market as the ultimate testing ground. Export finance from the China Development Bank came at rock-bottom 2% rates, and crucially: no NIMBY lawsuits blocking new factories, no endless environmental reviews paralysing progress.

To understand how China came to dominate the global solar market, we need to take a step back. Although the initial push for developing the solar industry was national security, as with the rest of China's economy, the early years of the industry were export-driven. In 2004, Chinese manufacturers were shipping panels to Germany's booming solar market. By 2008, China exported 95% of everything it produced as the domestic market barely existed. Then came the 2008 financial crisis. European subsidies collapsed. Chinese manufacturers, now massive and export-dependent, faced extinction.

The Chinese government's response wasn't ideological: it was pragmatic survival. Starting in 2009, they created domestic demand through subsidies to save their solar industry. By 2012, a real domestic market emerged. By 2015, China hit 43 GW of installed capacity, racing past their 35 GW target. The industry had been saved, but at a cost: chronic overcapacity.

The turning point came around 2015-2017. China's domestic market, whilst massive, was approaching practical limits. Grid curtailment rates in northwest provinces hit 12.6%; the system couldn't absorb more solar without major infrastructure upgrades. Meanwhile, Chinese manufacturers had built capacity for a global market that no longer existed at the prices they needed.

The solution revealed itself through the Belt and Road Initiative, launched in 2015. What started as infrastructure diplomacy became an outlet for Chinese solar overcapacity. By 2020, 'going overseas', chu hai in Mandarin, wasn't just about trade anymore. It was about survival in an industry where profit margins had collapsed to 1-3% and domestic saturation loomed.

But something unexpected happened on the way to solving their overcapacity problem: Chinese manufacturers cracked the cost code.

The Cost Breakthrough That Changed Everything

The Chinese Communist Party didn't set out to save the planet. They wanted energy security, and renewables were the only path to independence. So, they did what any rational actor would do: they went all-in on manufacturing scale.

The survivors of the brutal 2008-2012 polysilicon wars emerged with something unprecedented: the ability to produce solar panels at costs that made fossil fuels economically obsolete. By 2015, Chinese solar panels hit $0.50/watt, cheap enough to compete with coal in sunny regions. By 2020: $0.20/watt, cheaper than new coal everywhere. By 2025: $0.10/watt, cheaper than operating existing fossil fuel plants.

That last number changed everything. And as it turned out, the timing was perfect. Just as China's domestic market approached saturation and as overcapacity threatened the industry's survival, the cost breakthrough opened a market that no one had anticipated: the developing world.

The Export Surge: When Overcapacity Met Opportunity

By 2023, Chinese solar exports were exploding. In the first half of that year alone, China exported over 114 GW of panels worldwide, a 34% increase. But the geographic pattern was revealing. Africa registered the highest rate of growth of any region. Not Europe with its self-proclaimed green virtues, not the United States calling itself the innovation capital of the world. Walled off by self-serving tariffs, the developed world continued to rely on expensive fossil fuels for electricity generation. Africa, where over 40% of the population did not even have access to electricity, could not afford that luxury: it needed the cheapest electricity it could get its hands on.

The mechanism was simple: costs in China were 10% lower than in India, 20% lower than in the United States, and 35% lower than in Europe. When your manufacturing costs are $0.10/watt and Western competitors are at $0.34-0.46/watt, you don't need government support to dominate markets.

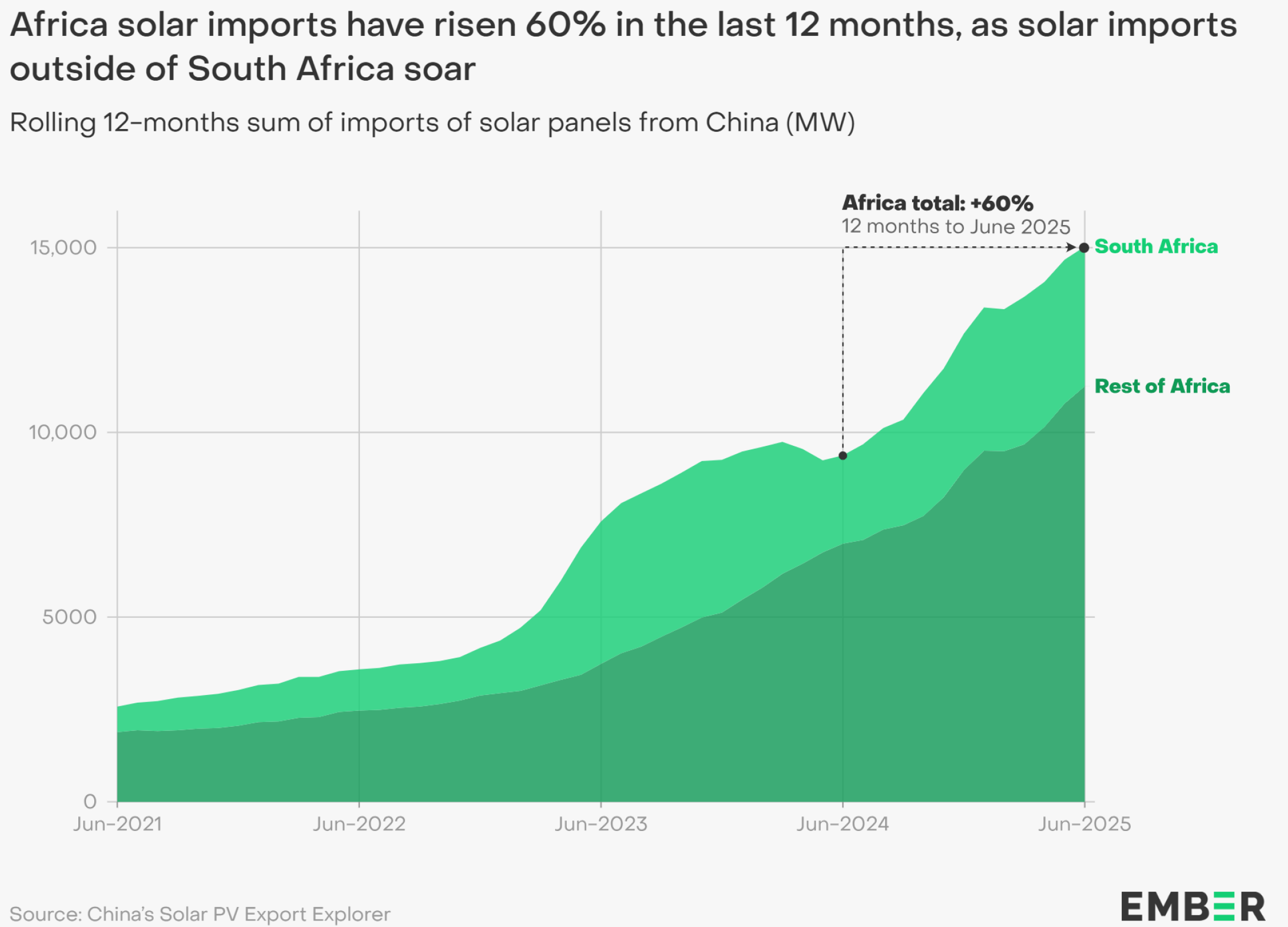

What followed in 2024-2025 was unprecedented. According to Ember, a UK clean energy think tank, Africa saw the largest percentage increase in solar installations worldwide in 2023-2024, whilst Pakistan's installations boomed, both driven by affordable Chinese panels. The surge in solar deployment across these developing markets was directly fuelled by the sharp decline in costs thanks to Chinese manufacturing innovation and aggressive export strategies.

Africa's solar imports from China set new records for both volume and speed of deployment, transforming solar from a niche technology into the fastest-growing power source across many developing regions. Solar deployment in developing economies was no longer bottlenecked by manufacturing capacity but by local finance and grid integration, directly reflecting the cost advantages exported from China. This cheaper supply validated China's role in making global solar expansion possible.

This wasn't Belt and Road diplomacy anymore. This was pure market forces, driven in many places by bottom-up processes: people desperate for cheap power to lift themselves out of darkness, literally!

The Purest Test: Pakistan's Energy Crisis

If we want to understand what happens when solar panels become genuinely cheap, remove subsidies, remove ideology, remove everything except brutal economic reality, we need to look at the particular case of Pakistan in 2024.

After years of economic mismanagement and the devastating floods of 2022 which wiped out 2.2% of its GDP, the country was in crisis. Pakistan was debt-crushed, blackout-plagued, with prices for grid electricity at $0.12-0.20/kWh when it worked at all. The government had no money for green energy subsidies. Foreign aid was focused on helping people survive, not subsidising clean energy.

Then Chinese solar panels arrived at $0.10/watt. The government saw an opportunity: in 2024 it dropped import taxes on Chinese solar panels to near zero. The response was instantaneous and overwhelming. In 2024, debt-crushed Pakistan imported a staggering 17 GW of solar panels, double the volume in 2023, making it the world's third-largest importer after only China and the US. Pakistani solar installations grew rapidly in 2024-2025, driven by Chinese panels that enabled both utility-scale projects and affordable off-grid solutions. Installations exploded to 15-20 GW in one year, more than the UK's entire cumulative total.

Drive through Lahore or Karachi today and you'll see rooftops sprouting panels like mushrooms after rain. Not because anyone cared about emissions but because businesses and homes were fleeing an unreliable, expensive grid for power that cost $0.04/kWh and actually worked. Pakistan's solar share jumped from under 5% to over 20% in parts of 2025. When government gets out of the way and the invisible hand of capitalism is allowed to work its magic, the results are stunning.

The alternative for Pakistan and dozens of other developing nations wasn't renewable energy subsidies or climate virtue. It was importing American liquefied natural gas (LNG) or Middle Eastern oil. In 2023, Pakistan paid $17.6 billion for fossil fuel imports, nearly 8% of its entire GDP. When Chinese solar panels at $0.04/kWh compete against LNG at $0.12-0.15/kWh for electricity generation, the choice is obvious. America's pitch to 'buy our freedom gas' couldn't compete with China's 'here's free sunshine, just buy the panels once'. Economics determined the winner.

Africa's Solar Revolution: The First Signs of Take-Off

Pakistan wasn't alone. Across Africa, the same market forces were triggering a solar revolution that aid agencies had tried and failed to ignite for decades.

Ember's 2025 report shows Africa imported a record 15 GW of solar panels in the year to June 2025, up 60% in just twelve months. Twenty countries shattered their import records. Nigeria (1.7 GW imported), Algeria (1.2 GW, a 33-fold jump in a year), and others are wiring homes and mini-grids faster than grids can extend.

But the real revolution wasn't in the statistics. It was in how it happened.

In Kenya, entrepreneurs paired Chinese solar panels with M-PESA mobile money to create pay-as-you-go systems that powered millions of homes. Cheaper than kerosene lamps. More reliable than diesel generators. In a country with limited or no grid connection, cheap Chinese solar panels allowed millions of people to have access to electricity for the first time. The market discovered what development economists had missed: poor people will pay for electricity if you make it affordable and accessible.

Tanzania's mini-grids, powered by Chinese panels, proved cheaper than extending the national grid to rural areas. Nigeria's off-grid solar systems now illuminate 5-10 million homes. Not as charity projects but as profitable businesses serving customers who previously had no alternative options.

These countries did not have carbon taxes or renewable portfolio standards. They had no money for feed-in tariffs or green subsidies. They just had Chinese panels at $0.10/watt making every alternative: diesel, kerosene, and coal, economically obsolete.

The Good Fortune of an Unintended Consequence

Here's the irony that should make every climate activist uncomfortable: the world's largest polluter became the planet's most powerful decarbonisation force by accident.

As stated previously, China didn't flood global markets with cheap solar to save the climate. They did it to secure their own energy supply and dominate a manufacturing sector. The fact that this triggered massive emissions reductions worldwide was a byproduct, not the goal.

But that byproduct is staggering. In 2024, developing countries (non-OECD) installed over 180 GW of solar capacity, 75% using Chinese panels. That's more than the entire US installed base, added in a single year, with essentially zero climate subsidies. Pakistan's solar boom will prevent tens of millions of tonnes of coal emissions annually. Africa's solar revolution is replacing diesel generators and kerosene lamps that poisoned the air in millions of homes. The climate impact is real, achieved not through moral appeals or international agreements, but through Chinese manufacturers making solar panels cheaper than burning stuff.

This is what actual decarbonisation looks like: not virtue signalling or climate conferences, but market forces making the clean choice the cheap choice. When solar hits $0.10/watt, you don't need to convince anyone to care about emissions. Economics does the work ideology never could.

What Markets Accomplished (That COPs Couldn't)

Thirty COPs couldn't get developing countries to abandon fossil fuels. Thousands of hours of negotiations. Billions in climate finance promises (mostly unmet). Endless discussions about 'common but differentiated responsibilities'. Then Chinese solar hit $0.10/watt, and Pakistan, Nigeria, Kenya, Tanzania, and many other nations across the world made the switch in a matter of months. Not because they signed a treaty or because wealthy nations paid them. It was the rational economic choice. The lesson is unavoidable: markets, not manifestos, drive energy transitions. Cost curves, not COP declarations, determine what gets built. China proved you don't need perfect climate policy to trigger decarbonisation at scale. You just need to make clean energy undeniably cheap. Do that, and even countries with no money for green virtue will choose solar. Not for the planet, but for their citizens' electricity bills.

At COP30, the world's climate delegates weren't queuing for China's ideology, they were queuing for a chance to participate in the quiet revolution of $0.10/watt solar panels that make fossil fuels obsolete. The ultimate irony of our age: a Communist Party saved capitalism from itself by showing what markets can actually do when you let them work. The world's largest polluter accelerating the decline in global fossil emissions. Whilst America retreats behind tariff walls and tries to hook nations on its dirty fossil fuels and the COP parties are arguing over minute points, China is selling the world a simple proposition: forget politics, here's cheap green energy. The world needs it now more than ever.